41 what is bond coupon rate

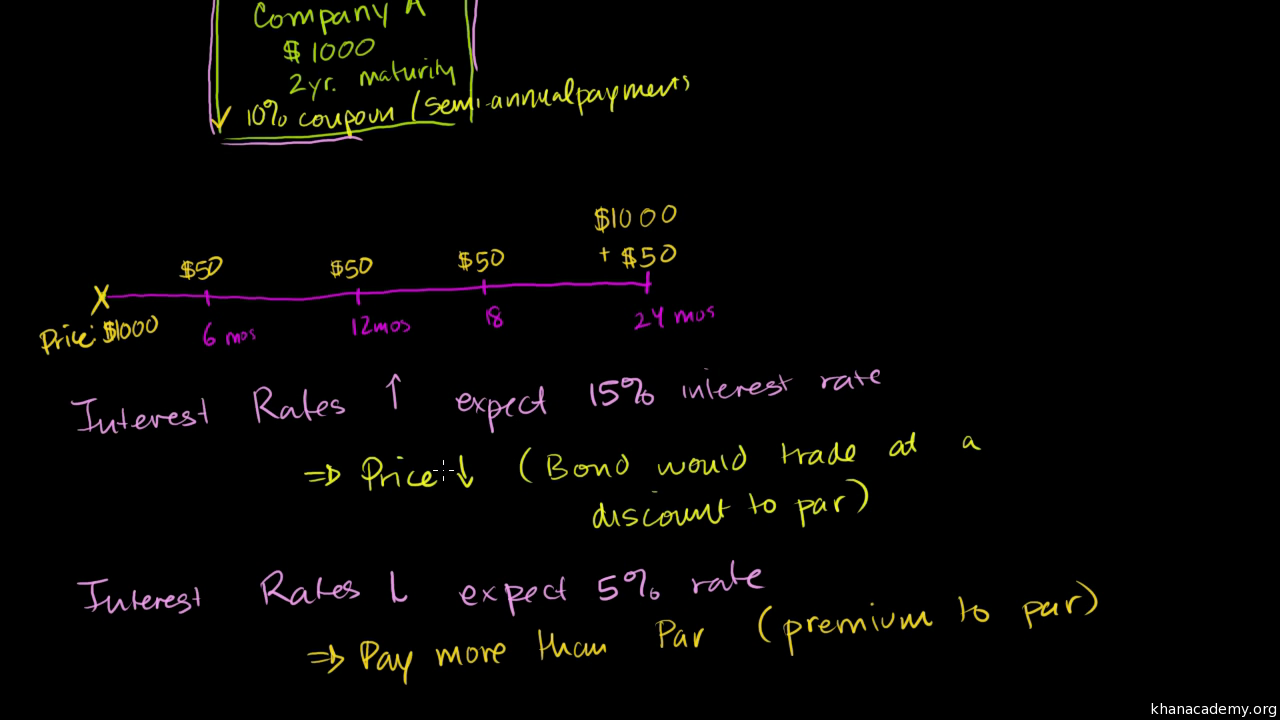

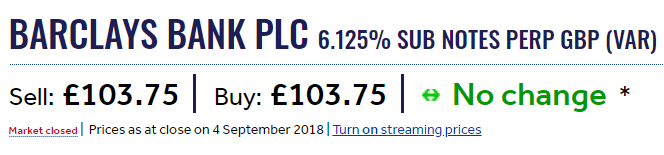

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations. Yield to Maturity vs. Coupon Rate: What's the Difference? 20.5.2022 · When a bond's yield differs from the coupon rate, this means the bond is either trading at a premium or a discount to incorporate changes in market condition since the issuance of the bond. Though ...

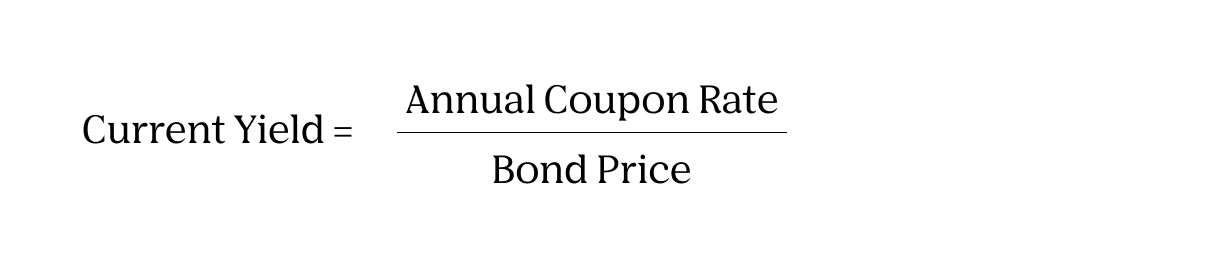

What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

What is bond coupon rate

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... When is a bond's coupon rate and yield to maturity the same? 13.1.2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. Coupon Definition - Investopedia 2.4.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

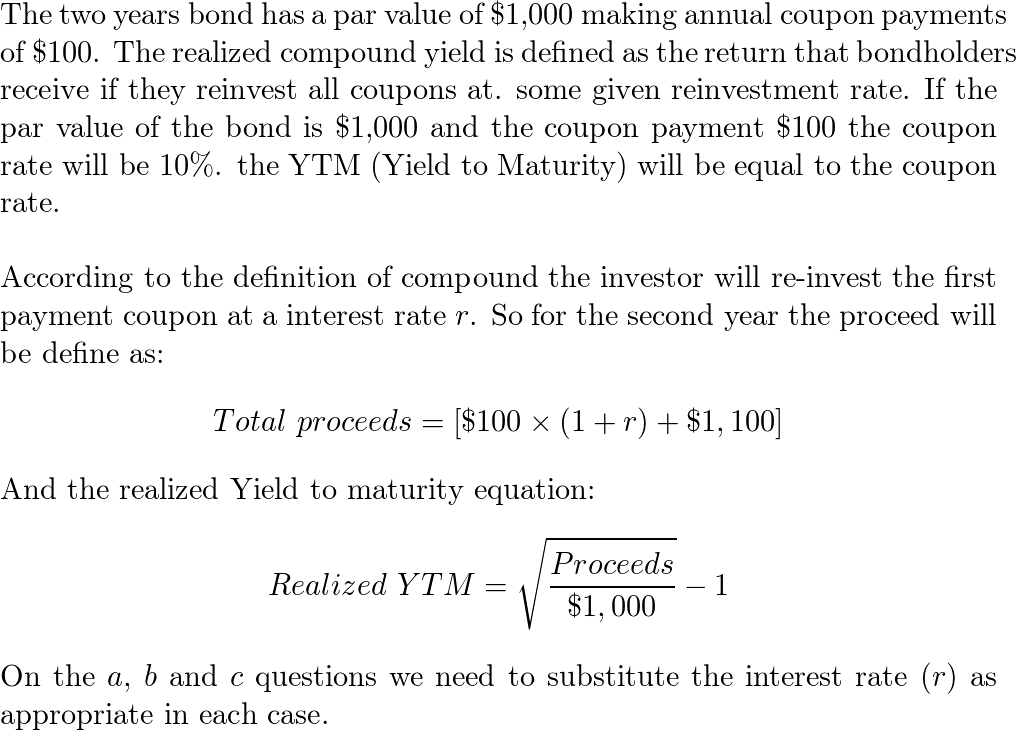

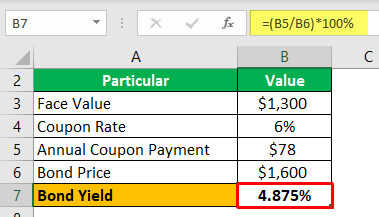

What is bond coupon rate. Coupon Rate Formula | Step by Step Calculation (with Examples) Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more ” refers to the rate of interest paid to the bondholders by the bond issuers The Bond Issuers Bond Issuers are the entities that raise and borrow money from the people who purchase bonds (Bondholders), with the promise of paying periodic interest and repaying the principal amount when the bond … Interest Rate Statistics | U.S. Department of the Treasury Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America’s Finances. Monthly Treasury Statement. Daily Treasury ... this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it … Bond duration - Wikipedia Consider a bond with a $1000 face value, 5% coupon rate and 6.5% annual yield, with maturity in 5 years. The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a …

Coupon Definition - Investopedia 2.4.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. When is a bond's coupon rate and yield to maturity the same? 13.1.2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 what is bond coupon rate"