42 zero coupon convertible bond

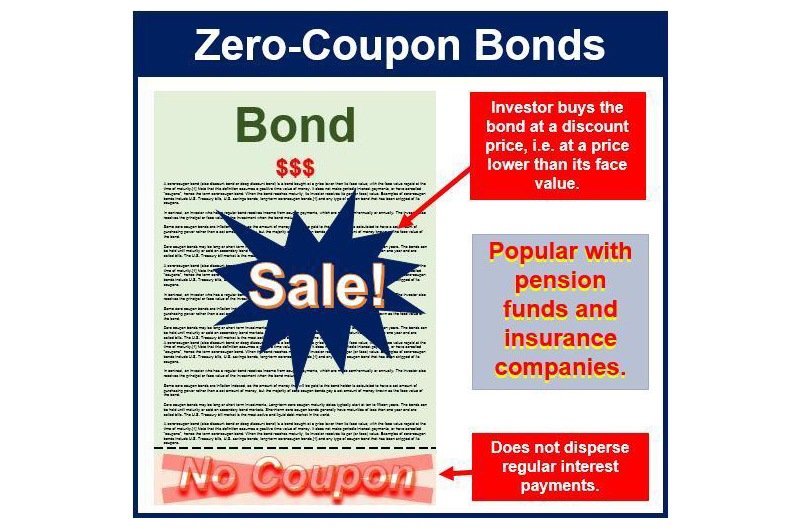

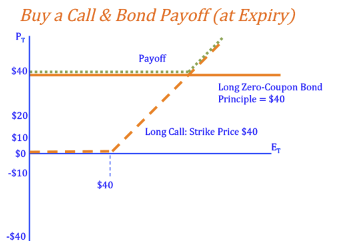

› knowledge › zero-coupon-bondZero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Features Zero-coupon bonds, also known as “discount bonds,” are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 “Premium” (Trading Above Par) If Price = 100 “Par” (Trading at Par Value) If Price < 100 “Discount” (Trading Below Par) Convertible bonds drop as investors cool on once-hot tech companies In February last year, home fitness company Peloton raised $1bn with a zero-coupon convertible bond. On the day it was sold, the company's share price closed just shy of $150. The bond sold with a...

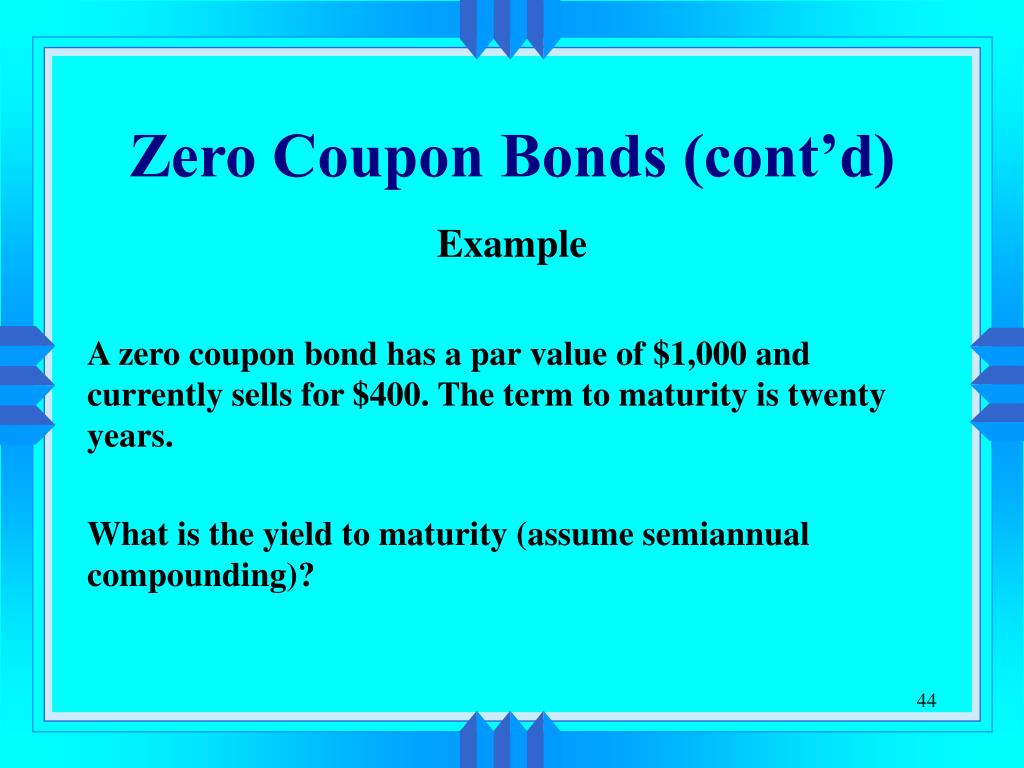

How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: =...

Zero coupon convertible bond

Convertible Bond - Types & Advantages of Convertible Bonds Convertible bonds are a flexible option for financing that offers some advantages over regular debt or equity financing. Some of the benefits include: 1. Lower interest payments. Generally, investors are willing to accept lower interest payments on convertible bonds than on regular bonds. Thus, issuing companies can save money on their interest ... Japanese Convertible Bond (JCB) service - Clearstream When the spreadsheet has been duly completed, you must email it to CorporateactionsICSD@clearstream.com quoting in the Subject line: " / Japanese zero-coupon convertible bonds Disclosure". The disclosure report must reach CBL at the latest by close of business (18:00 CET) on the eighth business day of the month following the redemption date. Types of bonds — AccountingTools A zero coupon convertible bond allows investors to convert their bond holdings into the common stock of the issuer. This allows investors to take advantage of a run-up in the price of a company's stock. The conversion option can increase the price that investors are willing to pay for this type of bond. Bond Features

Zero coupon convertible bond. ANA : Announcement on Issuance of Zero Coupon Convertible Bonds due ... ANA HOLDINGS INC. (the "Company") hereby announces that, at its board of directors' meeting held on 24 November 2021, the Company resolved to issue Zero Coupon Convertible Bonds due 2031 (the "Bonds") (the Bonds with stock acquisition rights, tenkanshasaigata shinkabu yoyakuken- tsuki shasai ). [Background of the Issuance of the Bonds] Plain Vanilla Bonds - Meaning, Features, Example, & Advantages There are many coupon features that can come in a bond. A bond can be a zero-coupon bond, ... Convertible Feature. When a bond comes with a conversion feature, this bond can be converted into equity shares or preference shares at a pre-determined date. They are called Convertible Bonds. A plain vanilla bond remains a bond until it is redeemed ... An Introduction to Convertible Bonds - Investopedia Convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. Companies issue convertible bonds to lower the coupon rate on debt and to delay dilution. A... Convertible Bonds Explained (2022): Everything You Need to Know Convertible bonds are typically issued with a par value or initial price of $1,000. Using our conversion ratio of 100, our conversion price would be $10 per share, since our $1,000 bond is divided into 100 shares of stock. The conversion value of a convertible bond is the price of the bond divided by the conversion ratio.

Zero-Coupon Bond - EC Cafe Envoy Textiles Ltd has decided to issue a non-convertible zero coupon bond valued at Tk 200 crore at a coupon rate of 6.5% to 7.5%. Of this amount, the company will use Tk 168.4 crore to finance its new ... Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities Record Run for Zero-Interest Convertible Bonds Hits a Wall Investors gobbled up convertible bonds with zero coupon from companies including Airbnb, SoFi, Snap, Ford, DraftKings, Twitter, Shake Shack, Spotify and Dish Network. They were essentially lending... › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

ZERO COUPON CONVERTIBLE NOTES - TaxDose.com ZERO COUPON CONVERTIBLE NOTES : These are debt convertible into equity shares of the issuer. If investors choose to convert, they forgo all the accrued and unpaid interest. These convertibles are generally issued with put option to the investors. The advantage to the issuer is the raising of convertible debt without heavy dilution of equity. Yaoko Lowers Conversion Price for Existing Zero-Coupon Convertible ... 8 8279. Food retailer Yaoko ( 8279) adjusted the conversion price for its zero-coupon convertible bonds due 2024 to 6,026.2 yen ($44.35) from 6,044.8 yen. The adjustment was made after the proposal regarding the appropriation of surplus for issuing the total dividend of 80 yen per share was approved on Tuesday, according to a filing on the same ... Zero Coupon 2025 Fund | American Century Investments Investment in zero-coupon securities is subject to greater price risk than interest-paying securities of similar maturity. Although you can potentially earn a dependable return if you hold your shares to maturity, you should be prepared for dramatic price fluctuations which may result in significant gains or losses if sold prior to maturity. C BSEC approves zero-coupon bond worth Tk 200cr for Envoy Textile The Bangladesh Securities and Exchange Commission (BSEC) has approved a non-convertible, redeemable, unsecured zero-coupon bond worth Tk 200 crore in favour of Envoy Textile Limited. The approval came at the 824th commission meeting held on Monday, according to a statement. The company will use the proceeds to repay debt and manage working capital. The zero coupon bonds are being issued as ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Record Run for Zero-Interest Convertible Bonds Hits a Wall is one of the few convertible-bond issuers this year, raising $425 million in an offering with a coupon of 2.5% in January. Still, don't expect coupons to rise too much. "We may not see zero coupons for a while, but it's not like we're going to see a 5% coupon," said Eli Pars, co-chief investment officer of Calamos Investments.

Fewer companies expected to issue low-yield convertible bonds The last two years marked a high point for zero-coupon bonds. Rising interest rates are taking that option off the table. Published Feb. 4, 2022 Robert Freedman Lead Editor designer491 via Getty Images Virgin Galactic raised $435 million in January by issuing a convertible bond with a 2.5% coupon rate.

Zero-Coupon Convertible - Investopedia Apr 11, 2022 · A zero-coupon convertible is a convertible bond issued by a corporation that pays no regular interest to bondholders. Because of the zero-coupon feature, these convertibles are sold at a discount...

Advantages and Risks of Zero Coupon Treasury Bonds These bonds are called convertibles. Banks and brokerage firms can also create zero-coupon bonds. These entities take a regular bond and remove the coupon to create a pair of new securities. This...

All the 21 Types of Bonds | General Features and Valuation | eFM Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). ... Convertible Bonds. Convertible bonds are a special variety of bonds that have an inbuilt feature ...

Construct synthetically a zero-coupon bond from coupon bonds A 3 year zero coupon bond will have the following cash ... Solution Summary The solution provides step by step instructions on the creation of zero coupon bonds using coupon bonds. Matrix algebra is used to arrive at the number of bonds to buy or sell. $2.49 Add Solution to Cart ADVERTISEMENT

Tech Bear Market's Latest Casualty Is Pandemic-Era Convertible Debt Zero-coupon convertible bonds hit by stock plunge, rate rises Low share prices leave tech firms with debt burden problem A Peloton showroom in Dedham, Massachusetts.

Record run for zero-rate convertible bonds hits a wall - OLTNEWS Prior to 2020, a zero-coupon convertible bond was a rarity. Between 2009 and 2019, only 18 companies issued convertible bonds that paid no interest, according to JPMorgan data. In 2020, there were 22 such offers. In 2021, there were 45. Among them: In March 2021, DraftKings raised nearly $1.3 billion with a zero-coupon convertible.

ConvertibleBond : Convertible Bond evaluation for Fixed, Floating and ... The ConvertibleZeroCouponBond function setups and evaluates a ConvertibleFixedCouponBond using QuantLib's BinomialConvertibleEngine and BlackScholesMertonProcess The NPV, clean price, dirty price, accrued interest, yield and cash flows of the bond is returned. For detail, see test-suite/convertiblebond.cpp . Usage

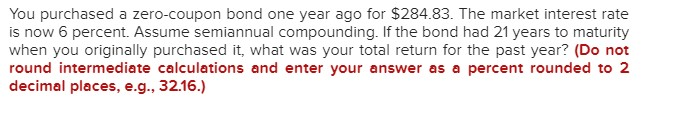

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Nippon Steel : Announcement Regarding the Issuance of Zero Coupon ... nippon steel corporation (the "company") hereby announces that the company has decided to issue zero coupon convertible bonds (bonds with stock acquisition rights, tenkanshasaigata shinkabu yoyakuken-tsukishasai) due 2024 (the "bonds with stock acquisition rights due 2024") and zero coupon convertible bonds due 2026 (the "bonds with stock …

Types of bonds — AccountingTools A zero coupon convertible bond allows investors to convert their bond holdings into the common stock of the issuer. This allows investors to take advantage of a run-up in the price of a company's stock. The conversion option can increase the price that investors are willing to pay for this type of bond. Bond Features

Japanese Convertible Bond (JCB) service - Clearstream When the spreadsheet has been duly completed, you must email it to CorporateactionsICSD@clearstream.com quoting in the Subject line: " / Japanese zero-coupon convertible bonds Disclosure". The disclosure report must reach CBL at the latest by close of business (18:00 CET) on the eighth business day of the month following the redemption date.

Convertible Bond - Types & Advantages of Convertible Bonds Convertible bonds are a flexible option for financing that offers some advantages over regular debt or equity financing. Some of the benefits include: 1. Lower interest payments. Generally, investors are willing to accept lower interest payments on convertible bonds than on regular bonds. Thus, issuing companies can save money on their interest ...

Post a Comment for "42 zero coupon convertible bond"