40 present value of coupon bond calculator

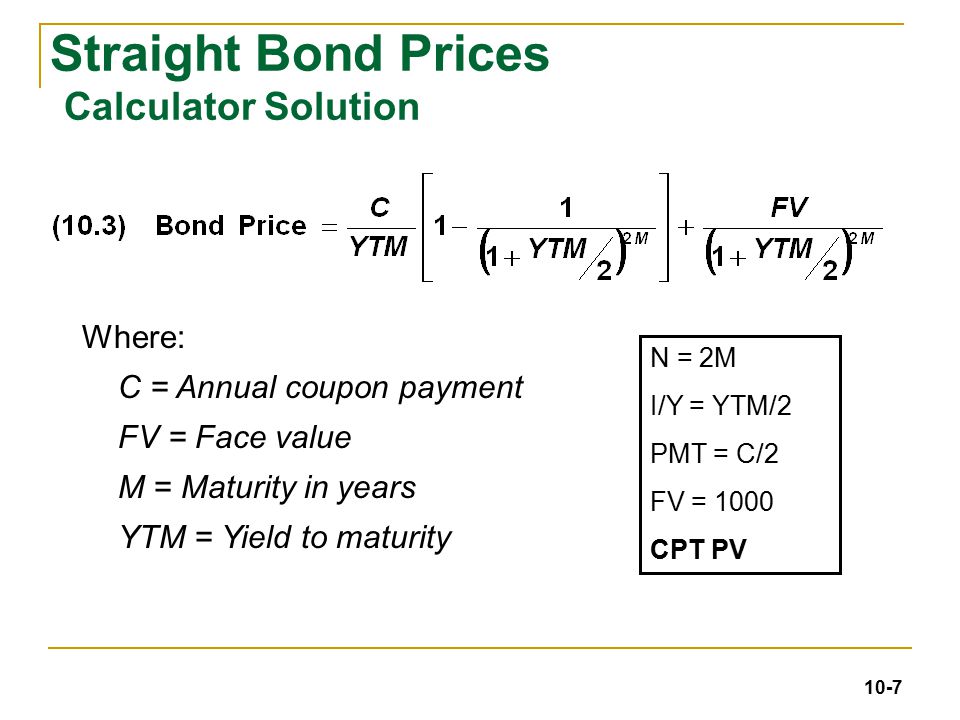

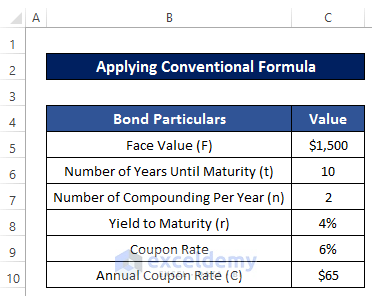

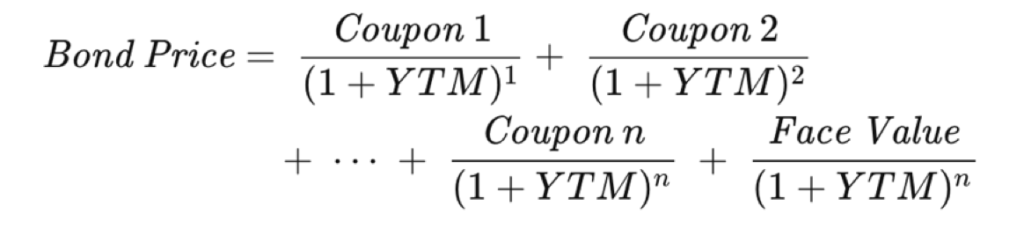

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Bond Price Calculator | Formula | Chart Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the ...

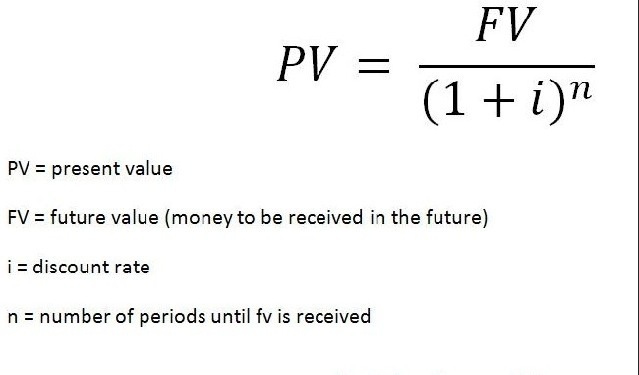

Present Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ...

Present value of coupon bond calculator

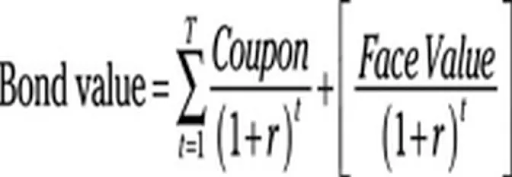

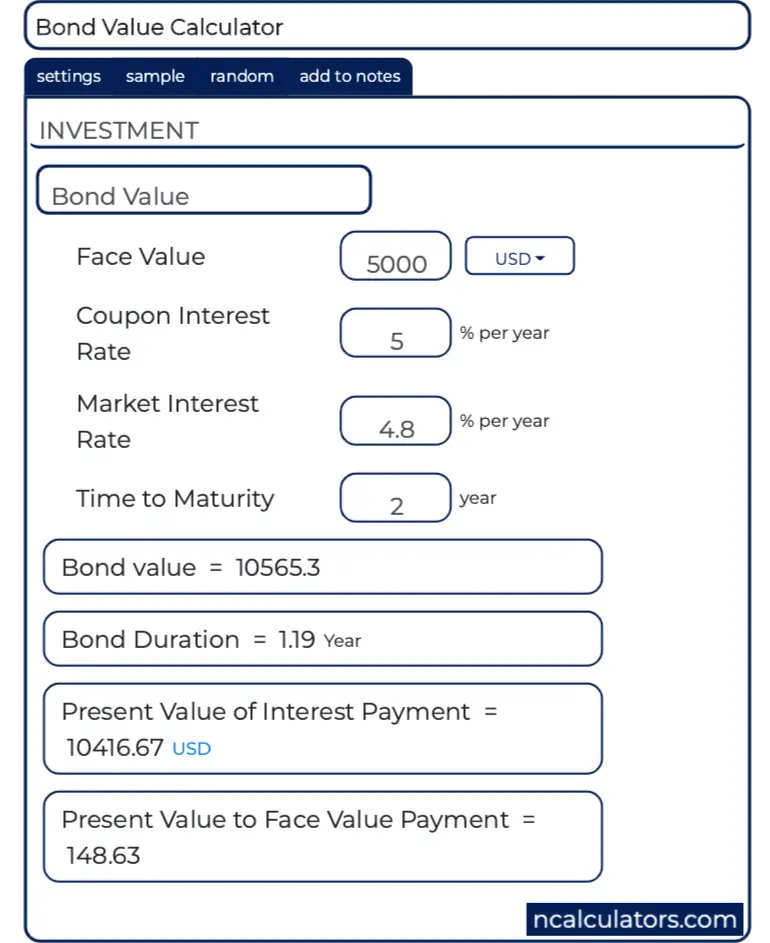

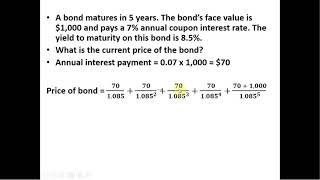

Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond is calculated by discounting the bond's future cash payments by the current market interest rate. In other words, the present value ... Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Bond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ...

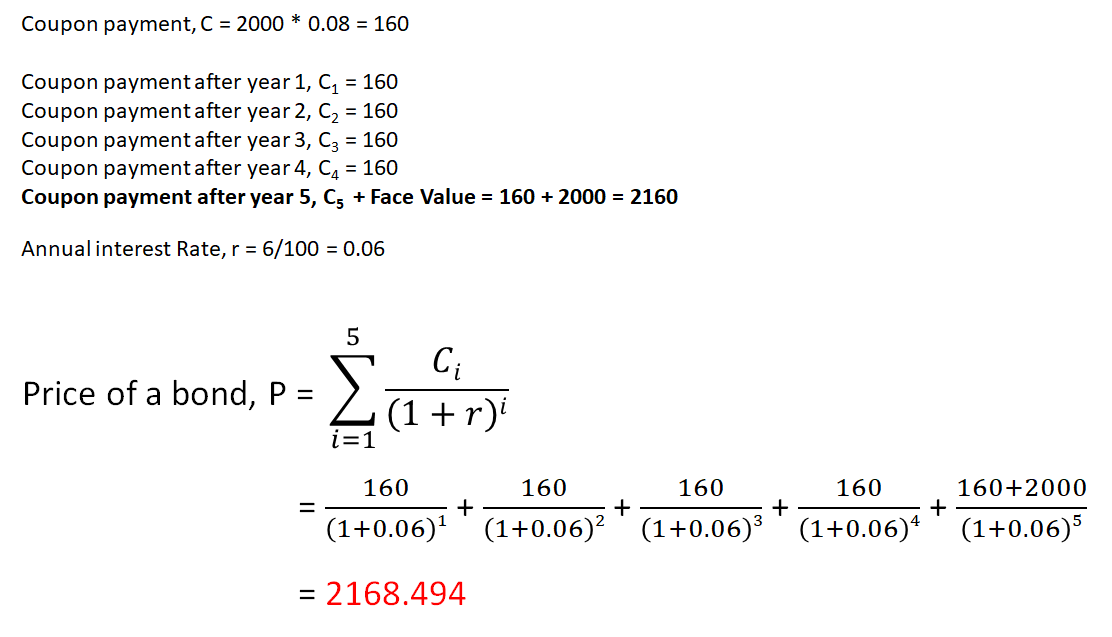

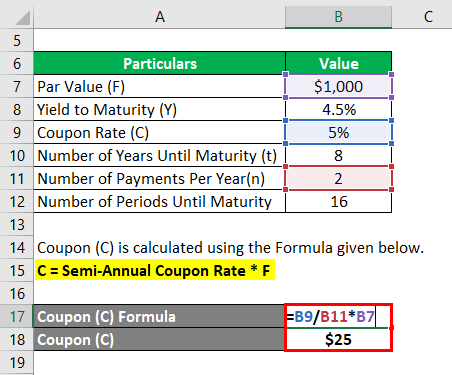

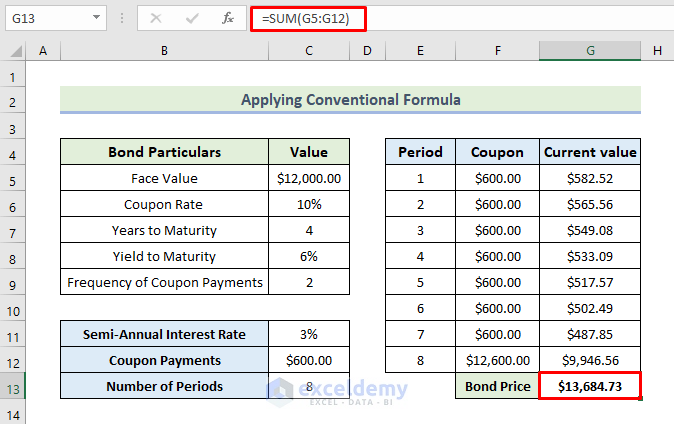

Present value of coupon bond calculator. Present Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ... Bond Valuation Calculator - RR Investor ... for trading in BSE and NSE stocks in India. Also find information about stock prices, national stock market analysis, stock market news and investment tips. Zero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... Bond Valuation: Calculation, Definition, Formula, and Example Coupon Bond Valuation · Present value of semi-annual payments = 25 / (1.015)1 + 25 / (1.015)2 + 25 / (1.015)3 + 25 / (1.015)4 = 96.36 · Present value of face ...

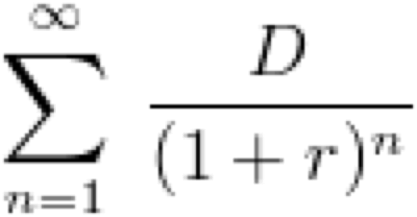

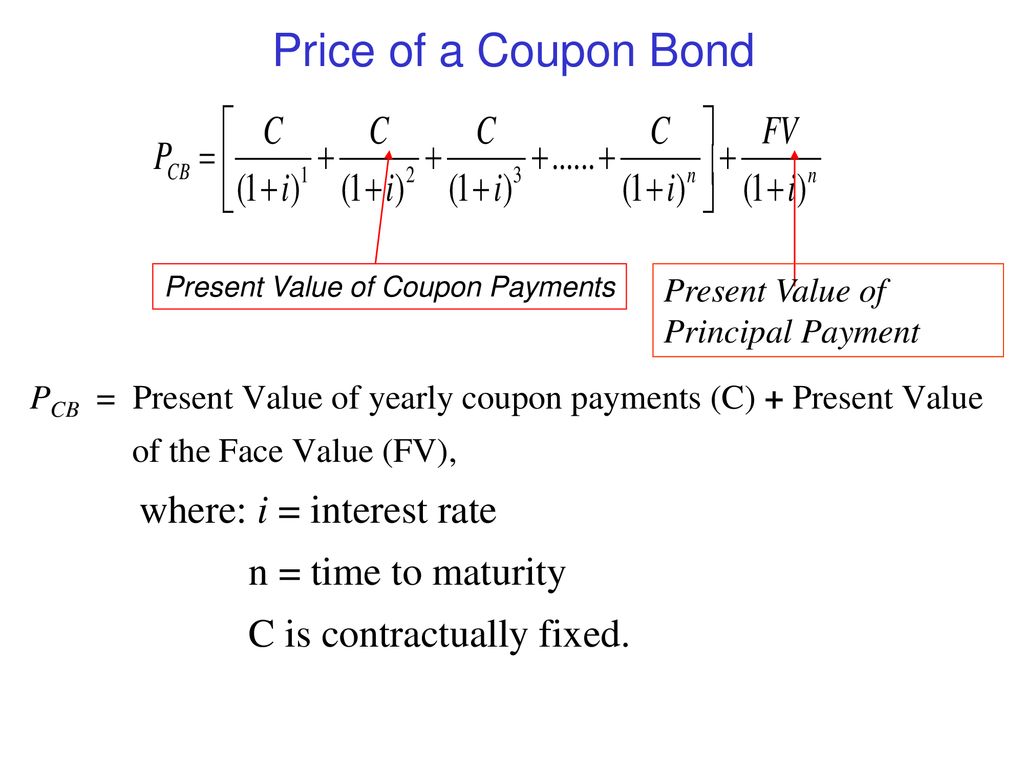

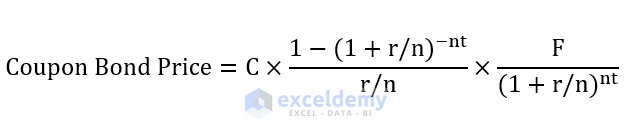

Coupon Bond Formula | How to Calculate the Price ... - WallStreetMojo The formula for calculation of the price of this bond basically uses the present value of the probable future cash flows in the form of coupon payments and ... Present Value of Annuity Formula | Calculator (With Excel ... Present Value of Ordinary Annuity = $1,000 * [1 – (1 + 5%/4)-6*4] / (5%/4) Present Value of Ordinary Annuity = $20,624 Therefore, the present value of the cash inflow to be received by David is $20,882 and $20,624 in case the payments are received at the start or at the end of each quarter respectively. Zero Coupon Bond Value - Financial Formulas (with Calculators) As shown in the formula, the value, and/or original price, of the zero coupon bond is discounted to present value. To find the zero coupon bond's value at its ... Bond Calculator - BioCRUDE Technologies The expected trading price is calculated by adding the sum of the present values of all coupon payments to the present value of the par value (no worries, the ...

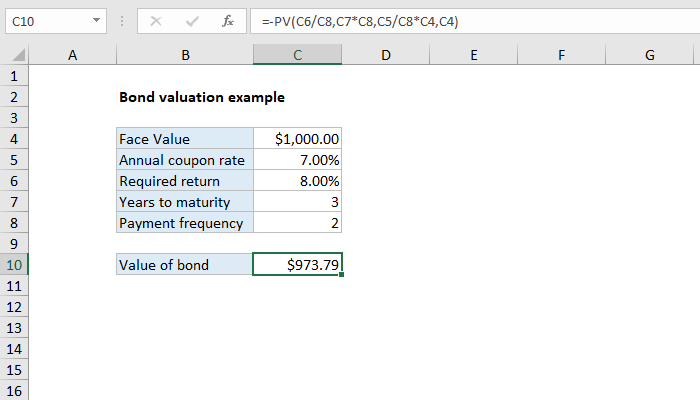

How to Calculate PV of a Different Bond Type With Excel How to Calculate PV of a Different Bond Type With Excel ; Bond Value = ∑ p = 1 n PVI n + PVP ; where: ; n = Number of future interest payments ; PVI n = Present ... Bond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ... Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond is calculated by discounting the bond's future cash payments by the current market interest rate. In other words, the present value ...

![Discount Rate Formula: Calculating Discount Rate [WACC/APV]](https://www.profitwell.com/hs-fs/hubfs/NPVEquation%20(1).png?width=780&name=NPVEquation%20(1).png)

Post a Comment for "40 present value of coupon bond calculator"